News — MetaQuotes

News

MetaTrader 5 has been named the "Best Multi-Asset Trading Platform" at Money Expo Colombia 2025. During the event closure, the organizers honored the best companies and brands for their outstanding achievements in the financial industry. Our platform has once again proven itself to be a leader in the field of trading technologies, thanks to innovative approaches and constant development.

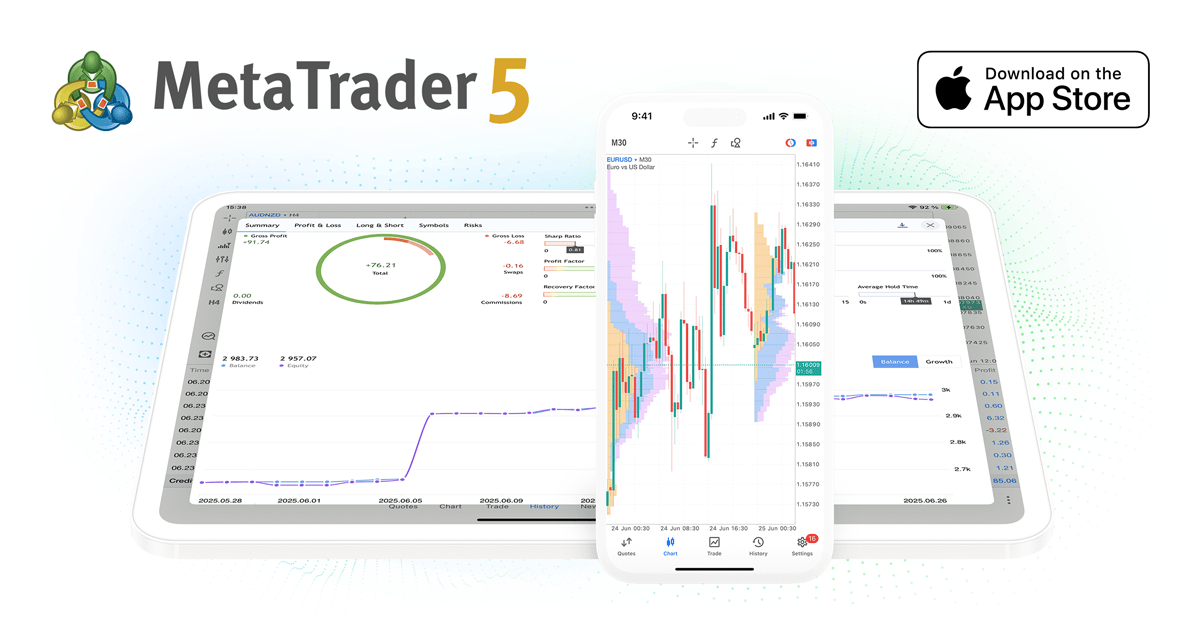

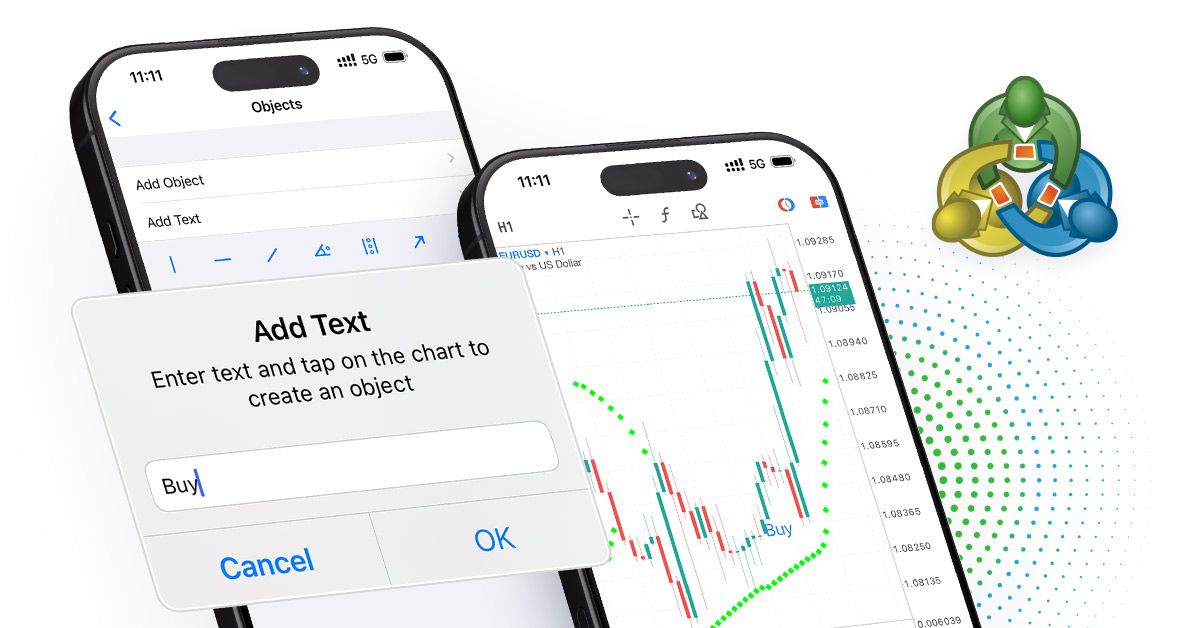

The latest versions of the MetaTrader 5 mobile app for iOS introduce a range of new features designed to help traders stay abreast of financial markets wherever they are.

MetaQuotes will showcase its latest innovations at Money Expo Colombia 2025 , scheduled to take place on June 25-26 in Bogotá, Colombia.

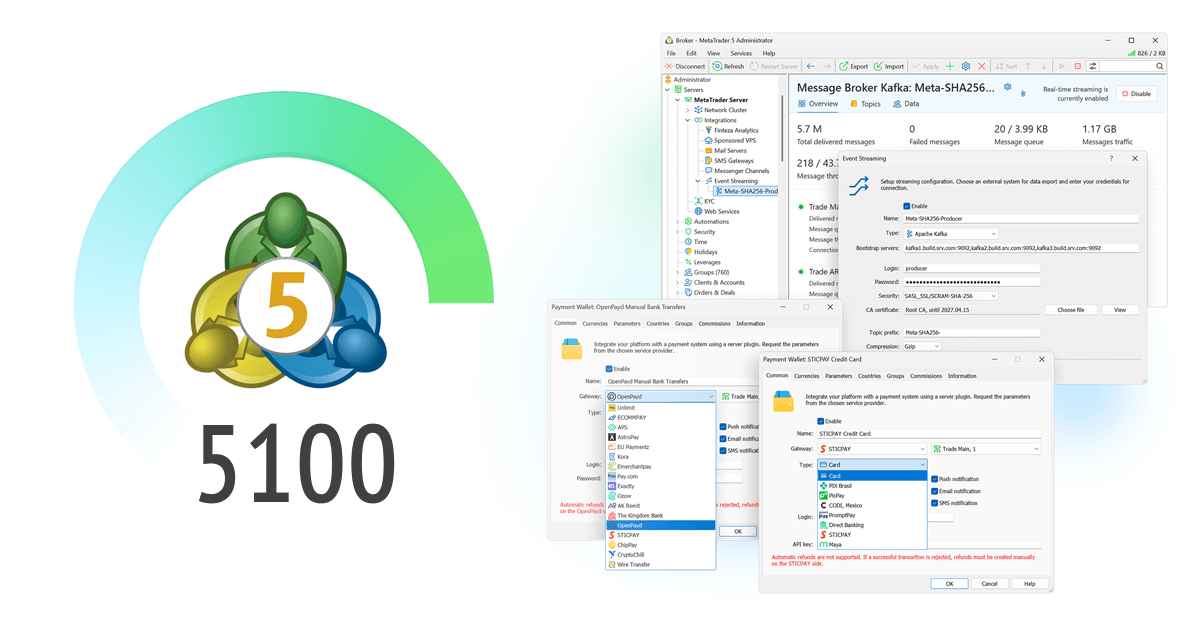

In this version, we have introduced a number of fixes and improvements to the platform.

From June 17 to 19, MetaQuotes will participate in the iFX EXPO International 2025 , a financial exhibition taking place in Limassol, Cyprus...

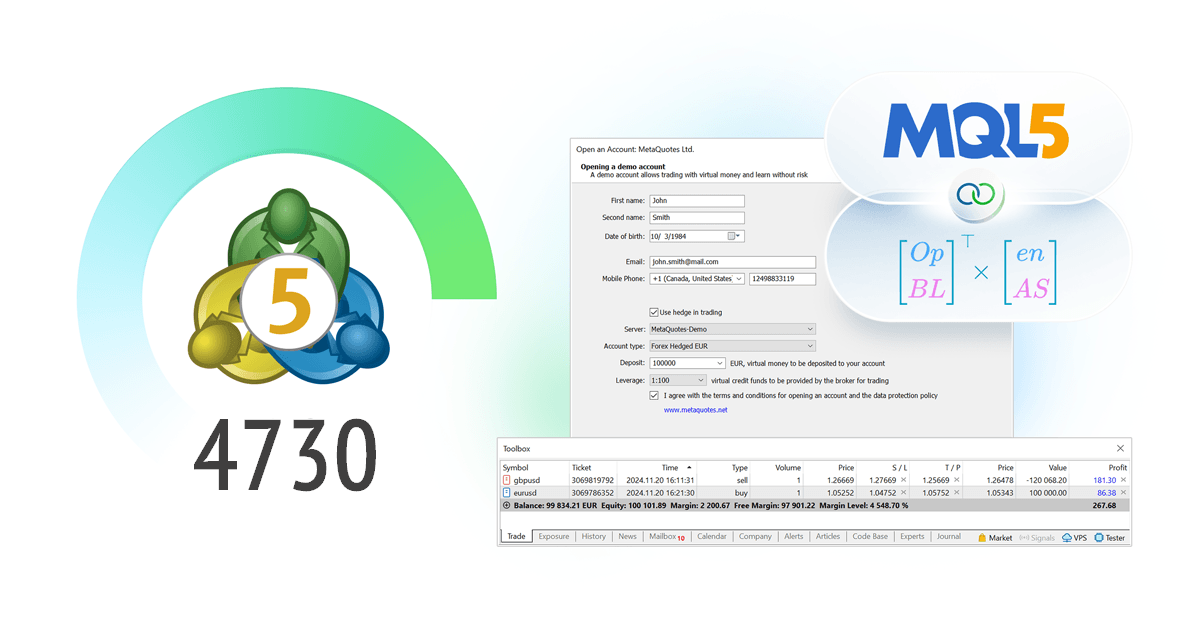

In this version, we have significantly revamped the MetaEditor source code editor. The built-in version control system, MQL5 Storage, has been migrated from Subversion to Git – the global standard for developers. With the transition to Git, we are introducing MQL5 Algo Forge, a new online portal for project management. Also, all platform components now support a dark mode interface

MetaQuotes will participate in the Finance Magnates Africa Summit 2025, taking place on May 29 and 30 in Cape Town, the financial hub of south Africa.

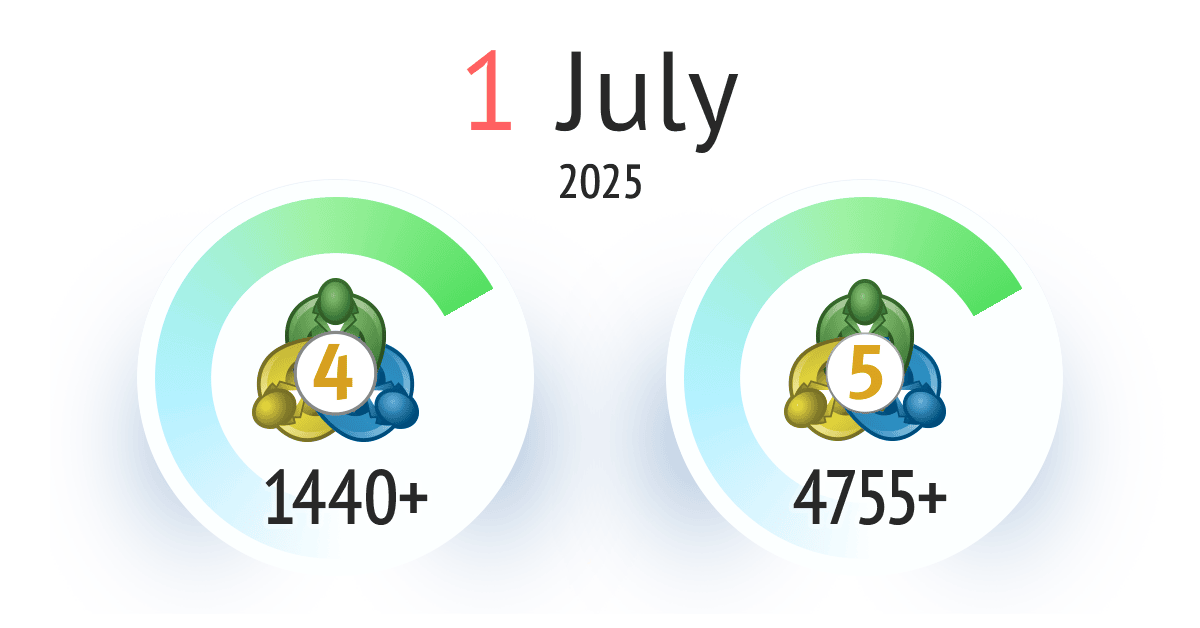

Starting July 1, 2025, the minimum supported versions of the trading platforms will be: MetaTrader 4 Build 1440 released on February 21, and MetaTrader 5 Build 4755 released on December 13, 2024.

The global regulated broker Just2Trade has streamlined its operations and significantly expanded its offering with MetaTrader 5 Automations.

From April 9 to 10, the MetaQuotes team will participate in iFX Expo LATAM 2025 , the region's largest B2B exhibition, held in Mexico City.

The latest versions of the MetaTrader 5 mobile app for iOS introduce a range of convenient chart features, along with important stability improvements

The international regulated brokerage Moneta Markets is seeing a significant rise in client demand for the MetaTrader 5 trading platform, recognizing it as a versatile and powerful tool for today's multi-asset traders

MetaTrader 5 has been awarded the top award in the Best Multi-Asset Trading Platform category at Money Expo 2025 Mexico. Once again, our platform has been recognized for its innovative approach and continuous development, reaffirming its status as a leader in trading technology.

MetaQuotes invites you to attend Money Expo 2025 in Mexico City, taking place on February 26-27 at Centro Citibanamex. This premier event brings together experts in investments, technology, and trading. Attendees will have the opportunity to connect with industry leaders, explore emerging trends in fintech, asset management, and blockchain, and experience cutting-edge innovations.

The Kingdom Bank, a digital-asset friendly international bank, has become part of the MetaTrader 5 Payments service. As a new PSP, the bank already offers services to the trading platform users. This latest integration strengthens our service and unlocks even more opportunities for brokers and traders.

MetaQuotes offers a solution that allows hedge funds to operate independently on a dedicated platform, reducing costs and providing complete control over assets. With MetaTrader 5, you can establish a multi-asset infrastructure in just a few days, eliminating the need for separate terminals and fragmented analytics.

On January 15 and 16, MetaQuotes will participate in iFX EXPO Dubai 2025, the world's leading exhibition for online retail, fintech and financial services, held at the Dubai World Trade Centre. Attendees at iFX EXPO Dubai 2025 will have the opportunity to showcase their products and services, forge valuable business connections and explore the latest innovations.

This update fixes an error in the calculation of triple swaps in the strategy tester, which occurred under certain combinations of testing conditions. Additionally, a number of minor enhancements and fixes have been implemented to further improve the platform stability.

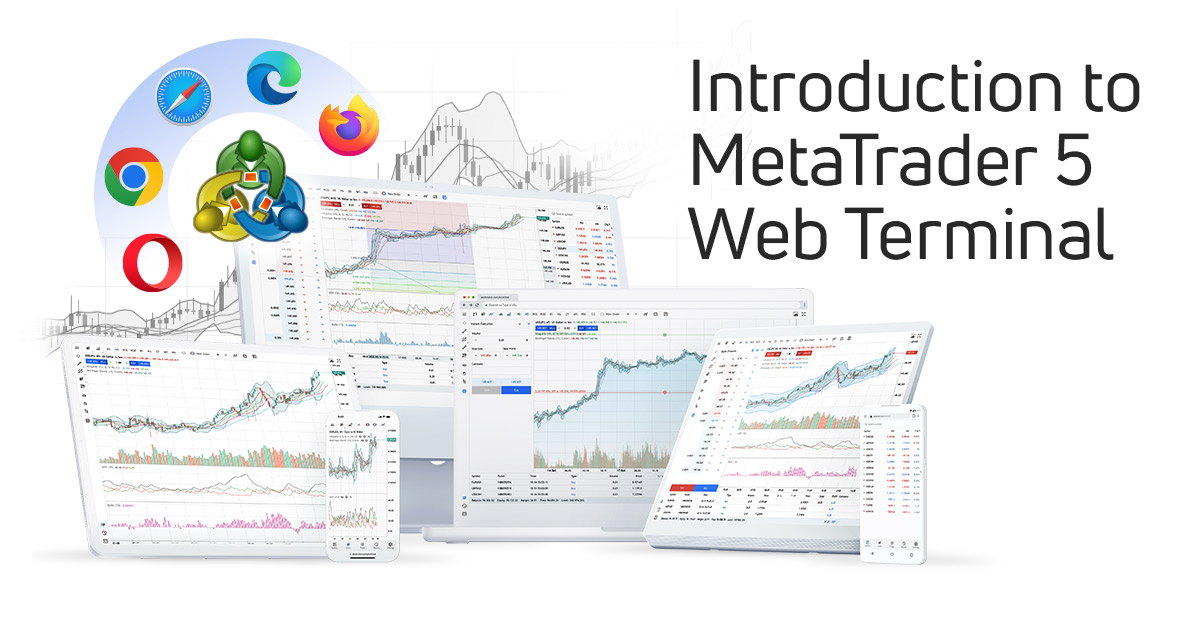

The MetaTrader 5 Web Terminal is an advanced, fast, and reliable trading solution. It operates on any device across all operating systems and does not require additional software installations. You only need a web browser to access your account. To help you get acquainted with the web terminal features, we have created a short video.

The MQL5 update introduces support for more OpenBLAS library functions, as well as the TransposeConjugate and CompareEqual functions. They will provide wider opportunities for working with matrices and vectors. In addition, we have fixed the compatibility for the Python integration package. It now operates with any Python version up to 3.13.