News — MetaQuotes

News

The multi-regulated broker HYCM has added 83 new stocks for trading on all account types in the MetaTrader 5 platform. The new instruments include popular assets, such as Nike, Adobe, Berkshire Hathaway, Dropbox, GoDaddy, and Gilead Sciences stocks.

The international investment fund has moved its trading infrastructure to the MetaTrader 5 platform. Now traders have all the benefits of the multi-asset platform, the most powerful algorithmic trading capabilities and a unique ecosystem of services from MetaQuotes.

MetaTrader 5 trading platform features improvements allowing traders to achieve better results.

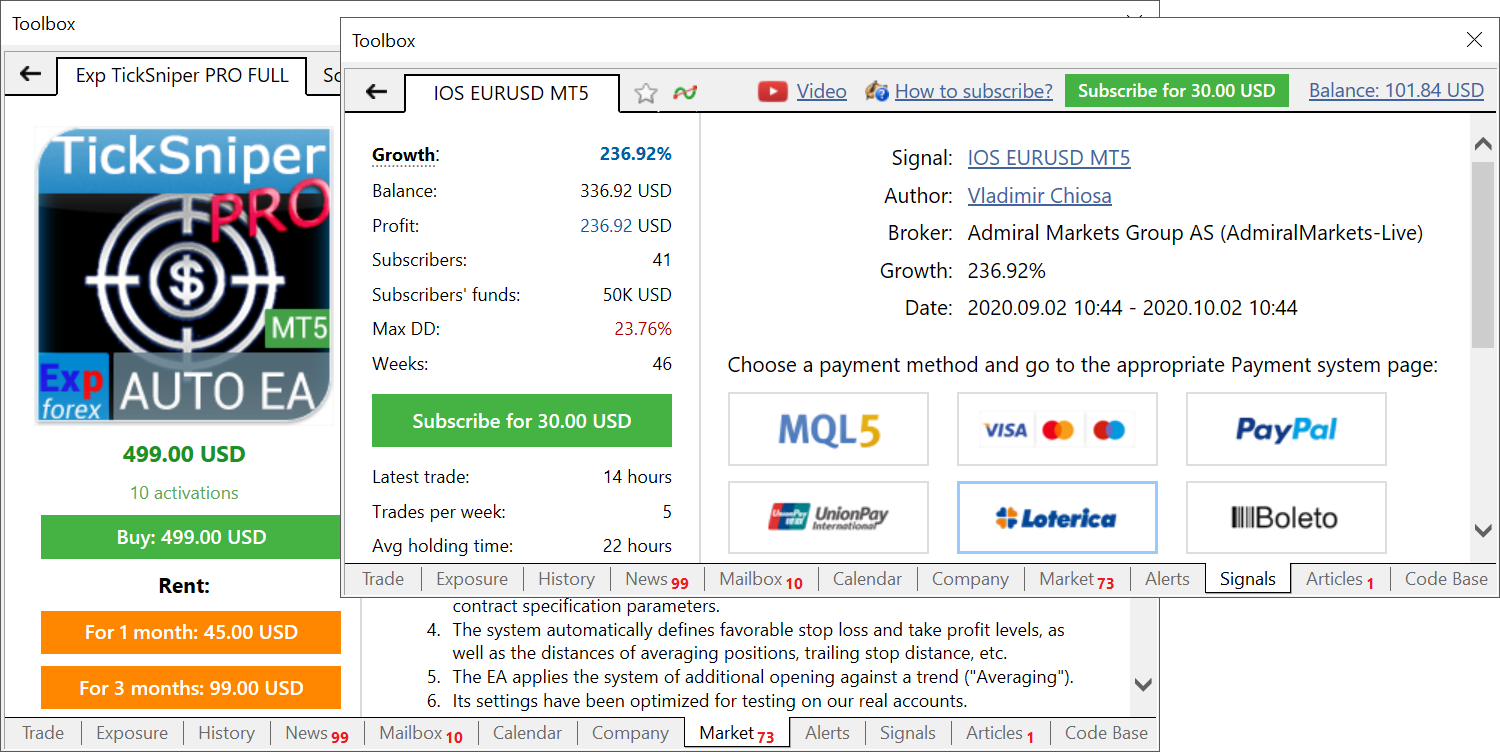

International licensed broker RoboForex has launched the Sponsored VPS program for its clients working via MetaTrader 5. The regular fee is USD 15 per month. However, traders are able to use the MetaQuotes VPS server integrated into the platform for free up to December 31, 2020.

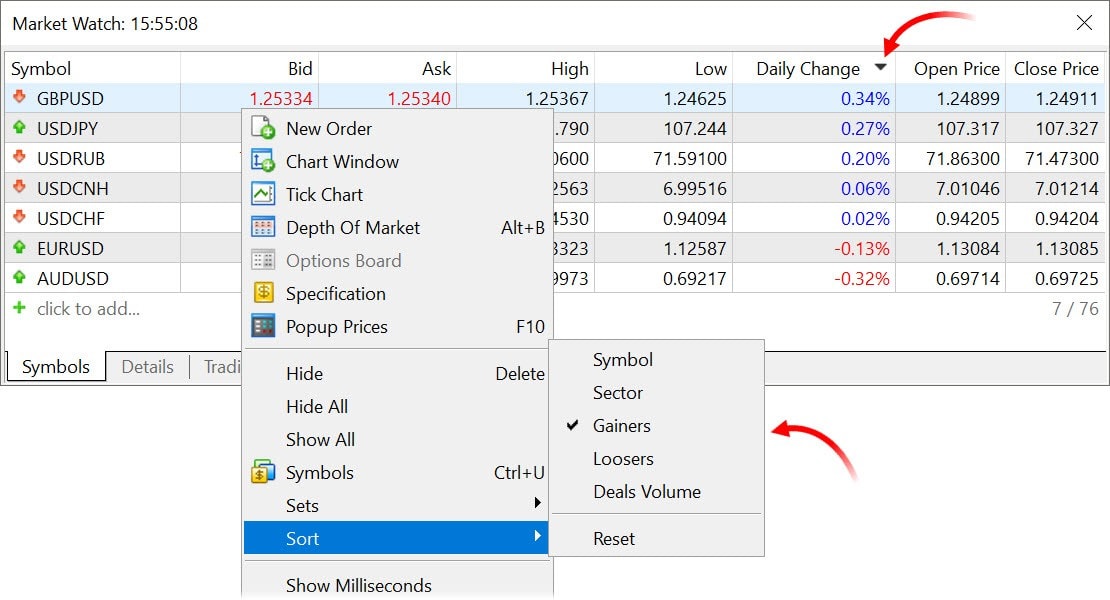

Expanded fundamental analysis facilities. Added new trading instrument properties, which enable a more accurate categorization of symbols

A regtech SaaS provider Sumsub has raised $6 million Series A funding round from a group of strategic investors to accelerate the global expansion of its machine-learning platform for user onboarding and KYC/AML compliance. The round, led by MetaQuotes, the major software provider for brokerages, banks, hedge funds and exchanges.

For connected brokers with a MetaTrader 5 server, direct integration to multiple brokerage APIs is no longer required. Instead, brokers can simply order the MetaTrader 5 Gateway for integration with dealers, such as DriveWealth, to perform trades on U.S. exchanges.

Through the trading platform, the broker's clients can enjoy a wide range of products, such as stocks and commodities, in addition to currencies, with high and flexible leverage facilities. Apart from offering advanced trading functions, MetaTrader 5 makes available a number of superior tools using which Accuindex traders can easily carry out fundamental as well as technical analysis and trade in

Orient Futures Singapore, a Singapore-based financial institution serving HFT traders for trading into exchange-traded and OTC market venues, has started offering the MetaTrader 5 platform to its clients globally. The launch of MetaTrader 5 adds to the growing suite of professional trading systems currently offered by the firm.

The main new feature is the Color on White chart color scheme. We have selected the most soothing colors which will help you navigate trends, at any chart scale, from a minute to a month. Old color schemes are still available.

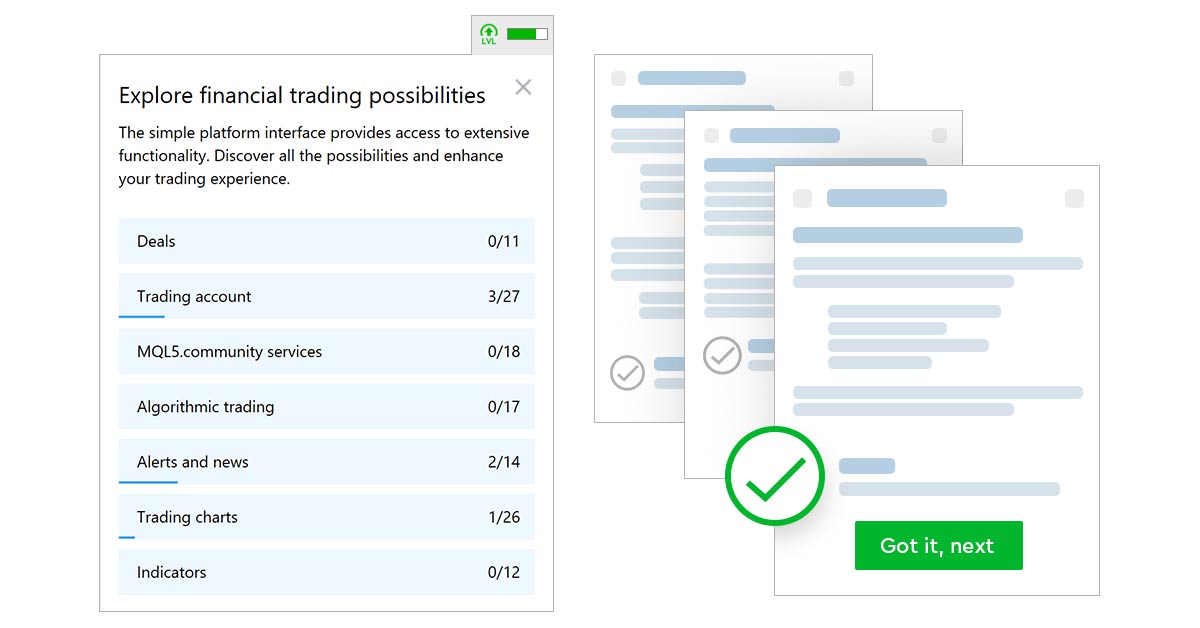

In the previous platform update, we have presented a completely revised learning system. Further improvements have been implemented in the latest version: The progress bar icon has become more visible The text of some hints has been revised Learning progress calculation has been fixed

We have revised the Achievements so that newcomers can get the hang of the platform and start trading faster, while experienced traders are able to find some additional ways to earn money. Now Achievements represent a full-fledged platform tutorial allowing you to track your progress.

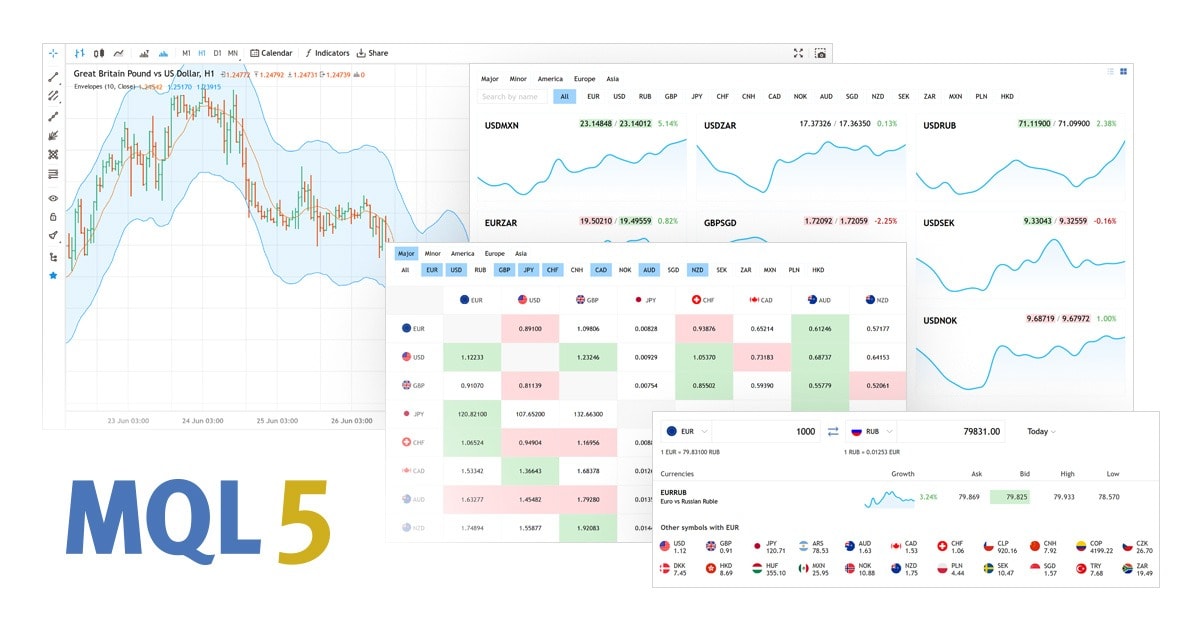

The website features the new Quotes section containing the relevant data on futures, financial and stock markets. It allows the monitoring of data from leading world exchanges and liquidity providers in real time.

In late 2018, the international broker Grand Capital offered its customers a new MetaTrader 5-based account. Introduction of the trading platform expanded the trading capabilities of the company's customers.

Click on a column name to sort the list by required data, such as the symbol name, close price, daily change or other variables. Use the new menu with the most popular sorting options. Sorting by the highest growth and fall based on a daily symbol price change can be useful when trading exchange instruments.

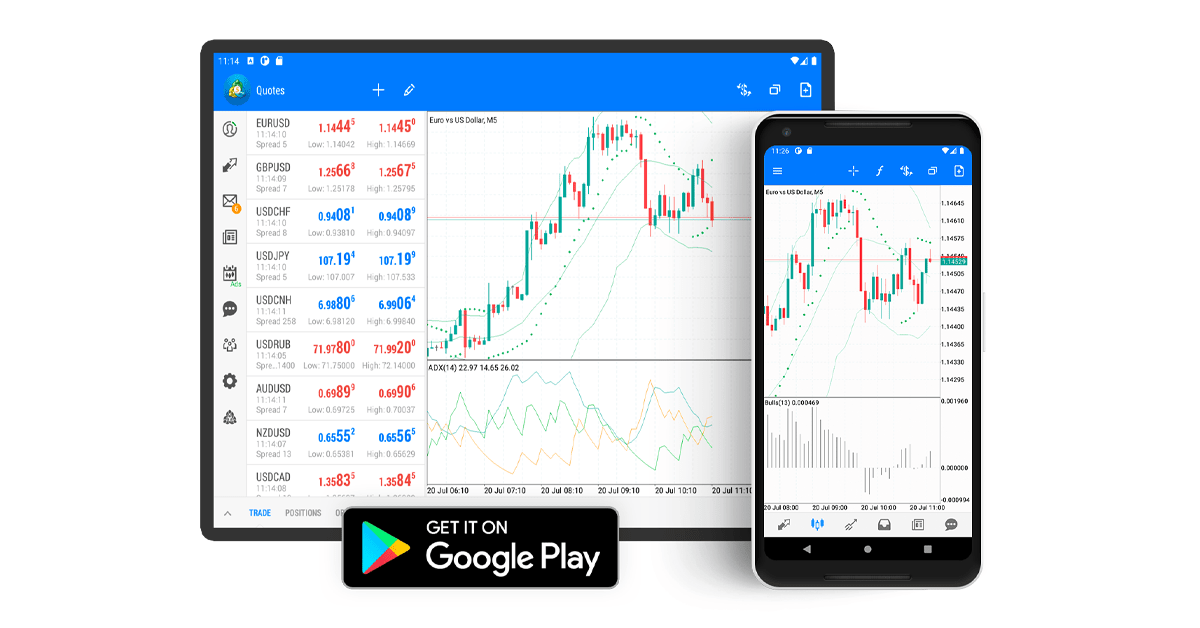

We have gathered feedback from MetaTrader 5 iOS users and overhauled the application in terms of appearance and functionality. The mobile platform is now more powerful, more efficient and more user-friendly.

We have gathered feedback from MetaTrader 5 iOS users and overhauled the application in terms of appearance and functionality. The mobile platform is now more powerful, more efficient and more user-friendly.

MetaTrader 5 has brought on Cloudflare, a performance, reliability, and security company, to enable DDoS protection and improve network performance. Cloudflare Spectrum for brokers prevents disruptions caused by bad traffic, while allowing good traffic through.

The MetaTrader 5 platform addition has been rolled out across Infinox's global offices, meaning its clients from around the world are now able to trade forex pairs, commodities, indices, futures and equities, including well-known corporation stocks such as Facebook and Apple.

Optimized and significantly accelerated bar history editing for custom financial instruments. The improvement also concerns the CustomRatesUpdate function.