News — MetaQuotes

News

Exinity Connect, the institutional arm of Exinity Group, announced the integration of MetaQuotes' new Ultency Matching Engine.

MetaQuotes is proud to be a Gold Sponsor at iFX Expo Asia 2025 , taking place October 26–28 in Hong Kong.

MetaQuotes has once again demonstrated its leadership in creating innovative solutions for the financial industry.

This release provides several important bug fixes

The global regulated broker BitDelta has fully embraced MetaTrader 5 Automations and is preparing to integrate MetaQuotes' next-generation solution for liquidity aggregation and ultra-low-latency execution.

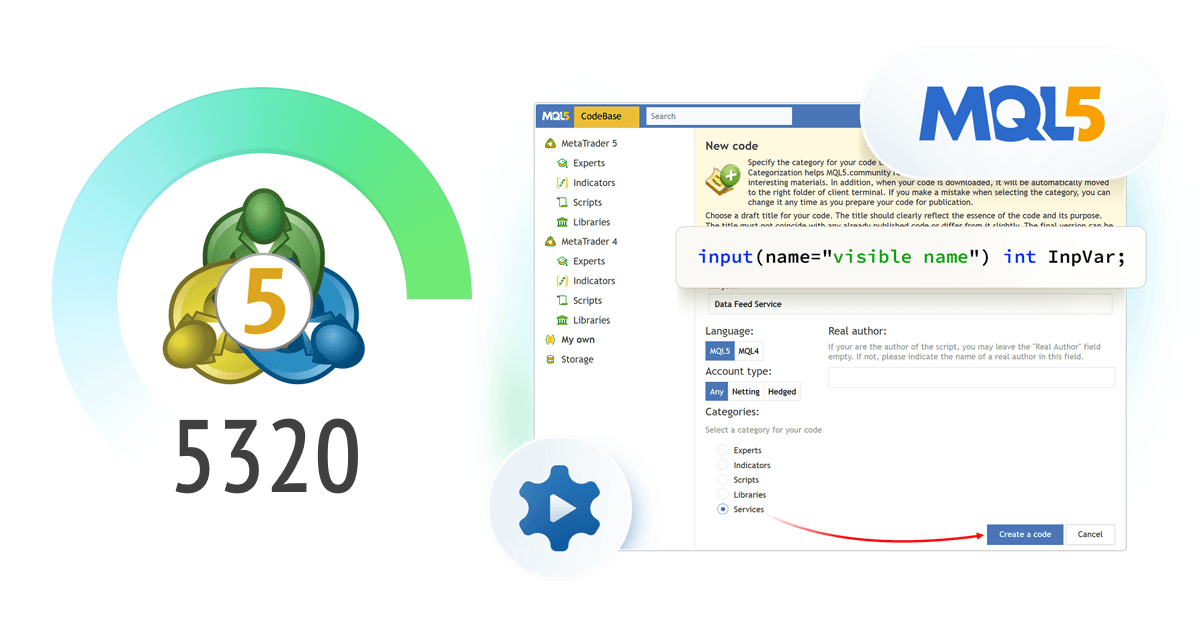

We have added a separate CodeBase category for services. Now you can easily share such MQL5 applications, as well as download them directly from the platform with automatic installation to the appropriate folder

This ready-made integration not only enhances the trading experience for clients but also strengthens JP Markets' position as a forward-thinking broker committed to leveraging technology for client success.

Join us in Dubai on October 6–7 for Forex Expo Dubai 2025, the Middle East's premier gathering for forex, fintech, and online trading professionals

MetaQuotes is pleased to announce its participation in the Jordan Financial Expo , taking place on September 23–24 in Amman.

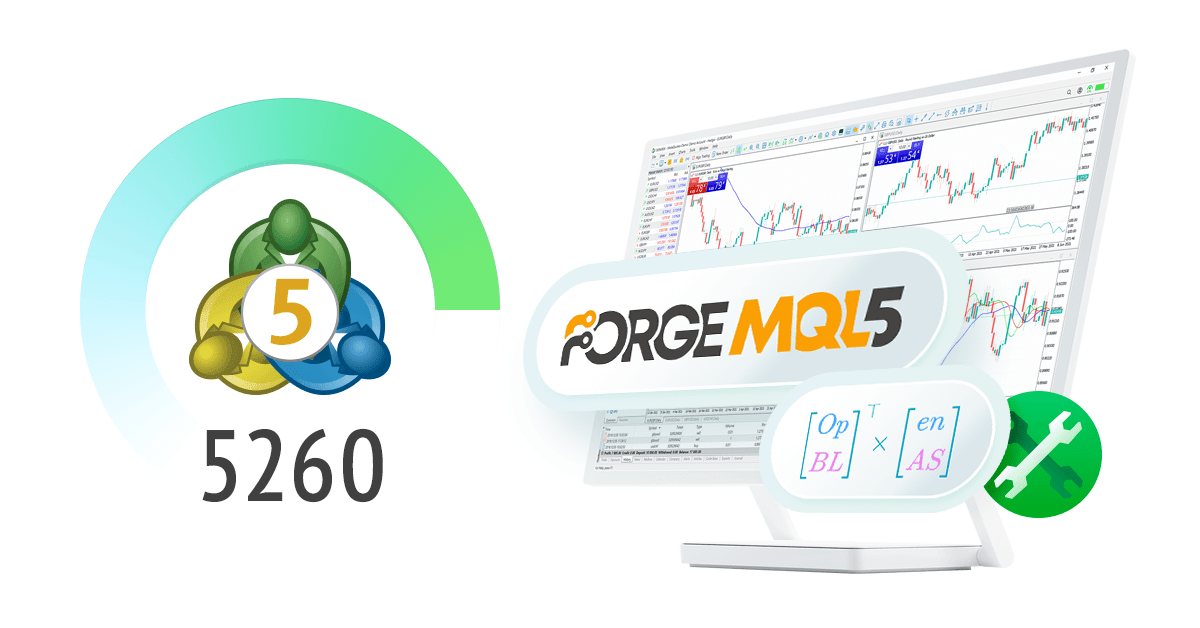

We've improved file handling in Algo Forge projects, accelerating hash calculations and eliminating false detections of file modifications.

On August 27–28, MetaQuotes will participate in Money Expo Chile . Although this exhibition is being held in Chile for the first time, it...

Join us at Wealth Expo, taking place on August 22-23 in Mexico City. We will present our latest solutions that can accelerate your business growth

In this version, we have significantly expanded support for the OpenBLAS linear algebra library in MQL5, adding nearly thirty new functions

The most comprehensive guide to programming in MQL5 is now available in four languages. In addition to English and Russian, translations into Spanish and Chinese have been released. This expansion allows even more users to explore algorithmic trading in their native language and in a format that suits them best.

MetaTrader 5 has been named the "Best Multi-Asset Trading Platform" at Money Expo Colombia 2025. During the event closure, the organizers honored the best companies and brands for their outstanding achievements in the financial industry. Our platform has once again proven itself to be a leader in the field of trading technologies, thanks to innovative approaches and constant development.

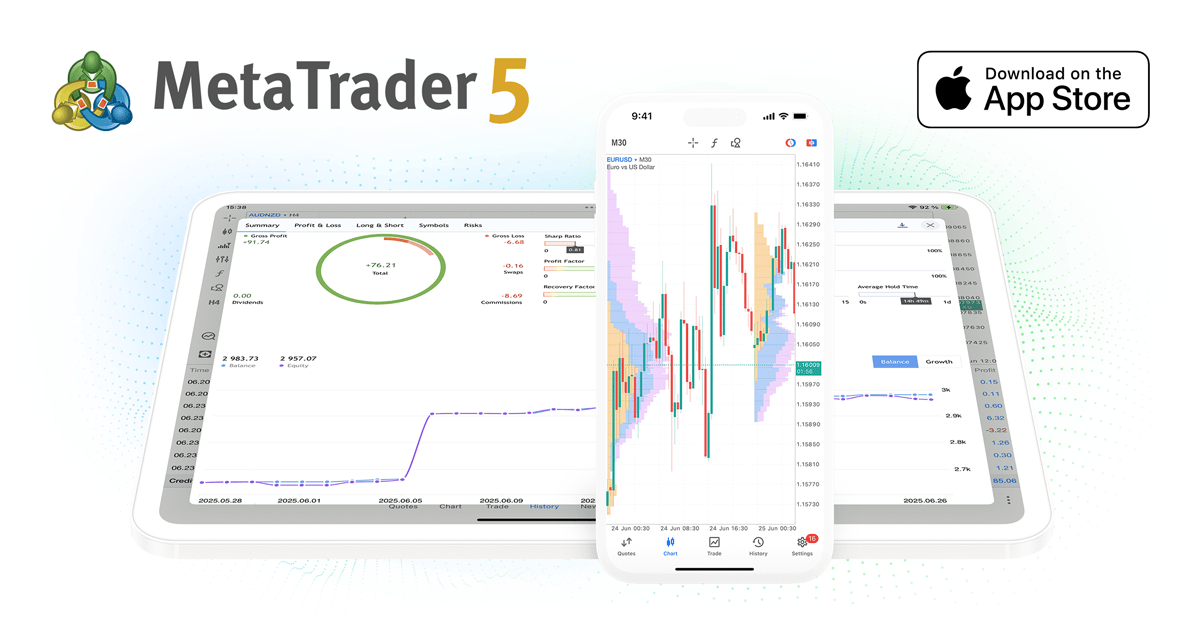

The latest versions of the MetaTrader 5 mobile app for iOS introduce a range of new features designed to help traders stay abreast of financial markets wherever they are.

MetaQuotes will showcase its latest innovations at Money Expo Colombia 2025 , scheduled to take place on June 25-26 in Bogotá, Colombia.

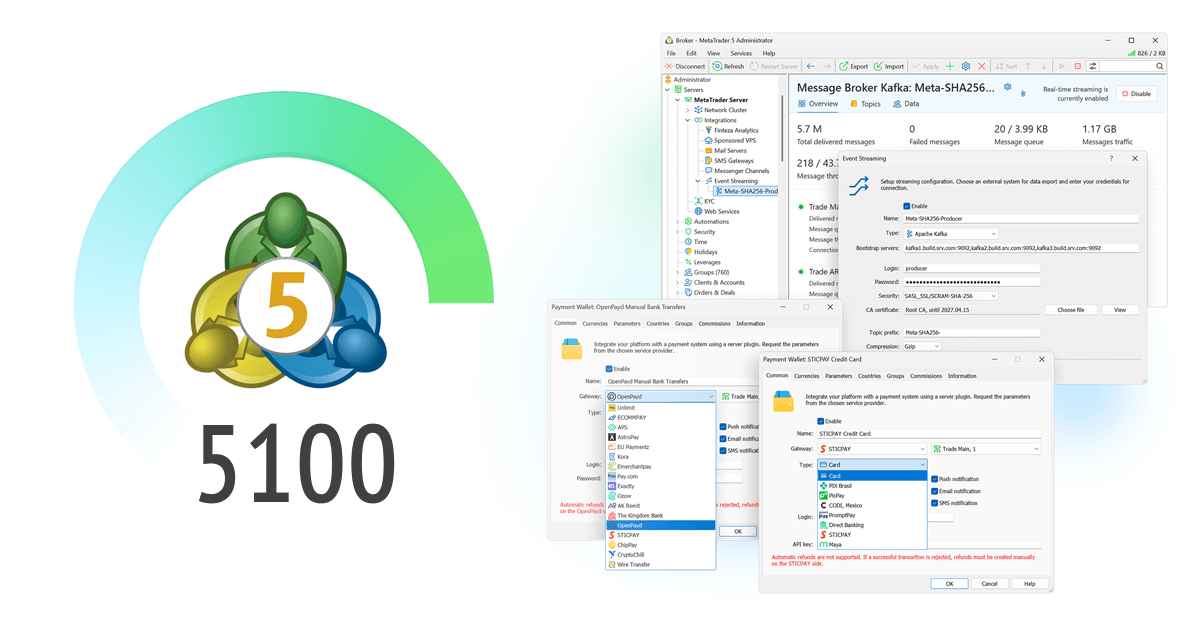

In this version, we have introduced a number of fixes and improvements to the platform.

From June 17 to 19, MetaQuotes will participate in the iFX EXPO International 2025 , a financial exhibition taking place in Limassol, Cyprus...

In this version, we have significantly revamped the MetaEditor source code editor. The built-in version control system, MQL5 Storage, has been migrated from Subversion to Git – the global standard for developers. With the transition to Git, we are introducing MQL5 Algo Forge, a new online portal for project management. Also, all platform components now support a dark mode interface