Trading

Trade Forex, stocks and futures. Gain the widest opportunities for

trading currencies, stocks and other instruments: technical and

fundamental analysis, algorithmic trading, two position accounting

systems, a full set of trading orders, one-click trading, and more.

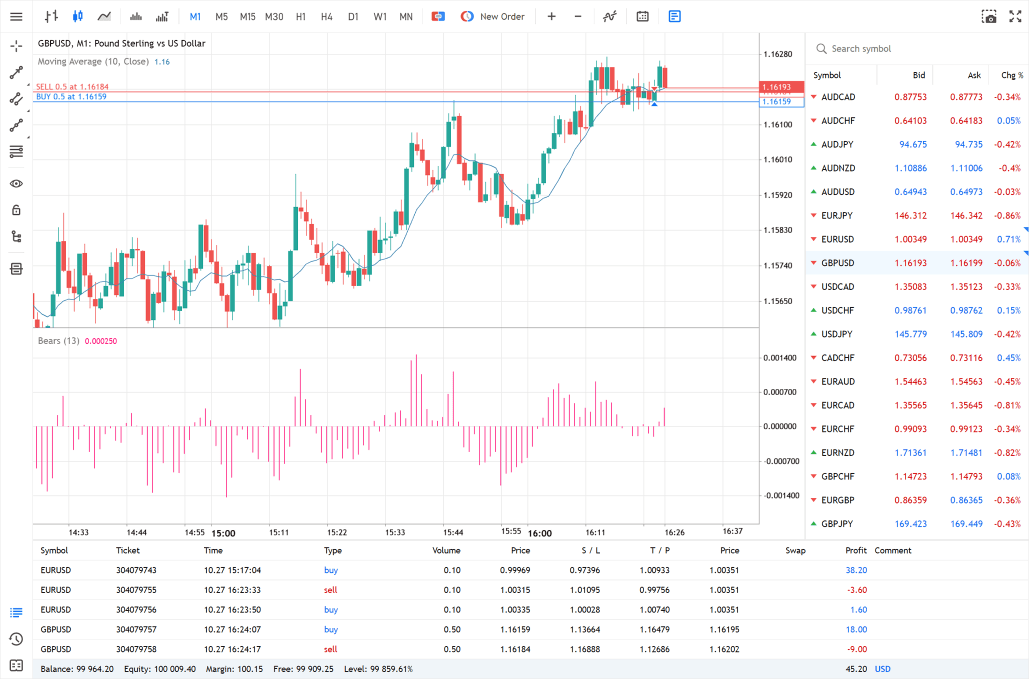

Netting and hedging position accounting systems

You have access to two order accounting modes: the netting mode is

adopted on exchange markets, while the hedging method can be used for

Forex trading. With the netting system, the trader will be able to have

only one open position of a financial instrument at a time. The volume

of that position can be increased or reduced through any further

operations on the same symbol. With the hedging system, any new deal on a

financial instrument opens a new position. Individual Stop Loss and

Take Profit levels can be set for each of the open positions.

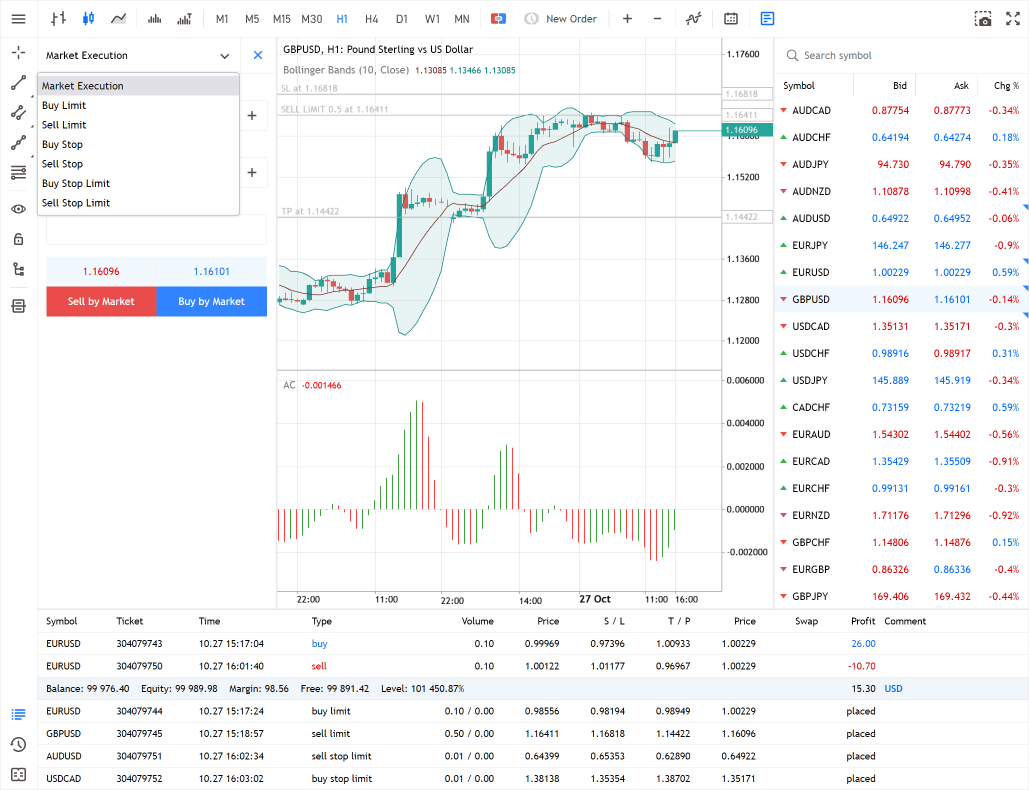

Full set of trading orders and all types of execution

The web platform supports all types of trading orders, including

market, pending and stop orders, as well as Trailing Stop. Four order

execution modes are available to meet various trading objectives:

Instant, Request, Market and Exchange execution.

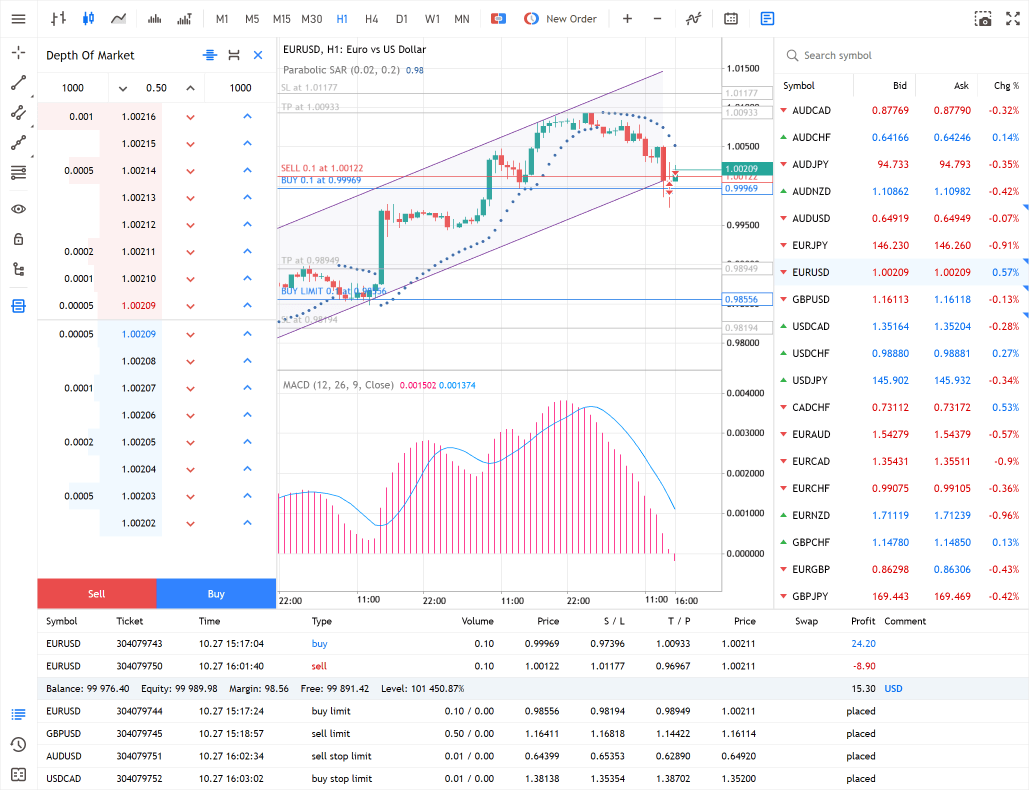

Advanced market depth and one click trading

The market depth is one of the basic tools reflecting supply and

demand for liquid tradeable assets. It displays buy and sell offers for a

financial instrument at the best prices, which are closest to the

market one. Using the market depth in MetaTrader 5, you can buy or sell

financial instruments at the current market price as well as place

pending orders at desired prices. The market depth allows users to

manage stop levels (Stop Loss and Take Profit) of open positions and

pending orders in one click.

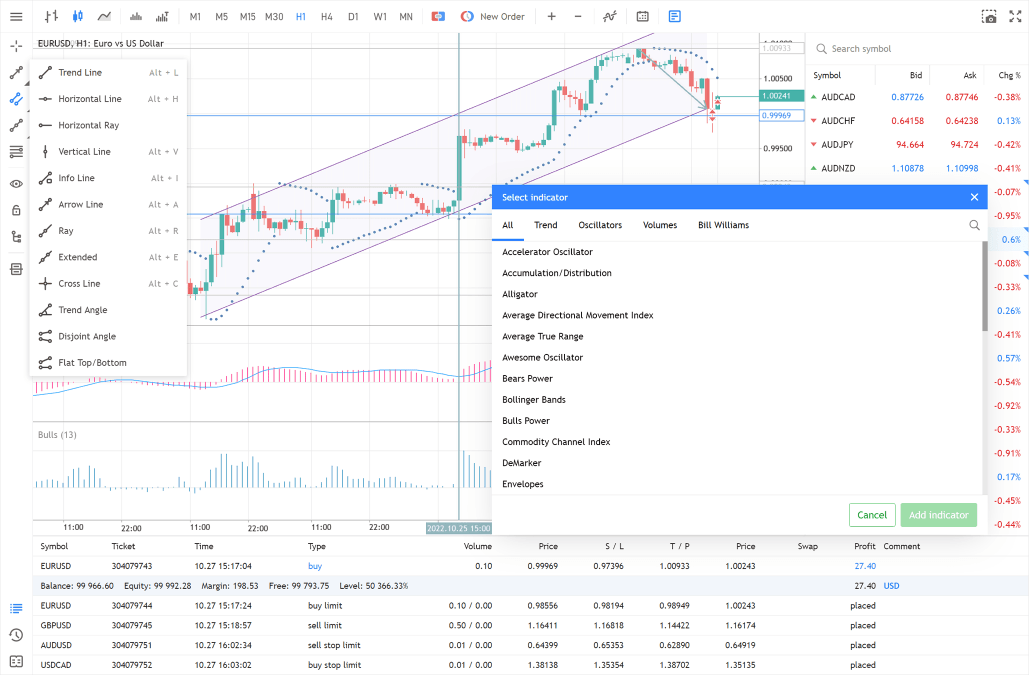

30 indicators and 24 graphical objects for technical analysis

The platform features the most popular technical indicators: trend

indicators, oscillators, volume indicators and Bill William's tools. The

settings of most indicators allow you to adapt them to specific tasks.

You control both analytics and appearance. Indicators can be added to

price charts or to a separate sub-window with an individual scale of

values. Some tools can be superimposed on others: for example, you may

apply a Moving Average on DeMarker and obtain a line of averaged values.

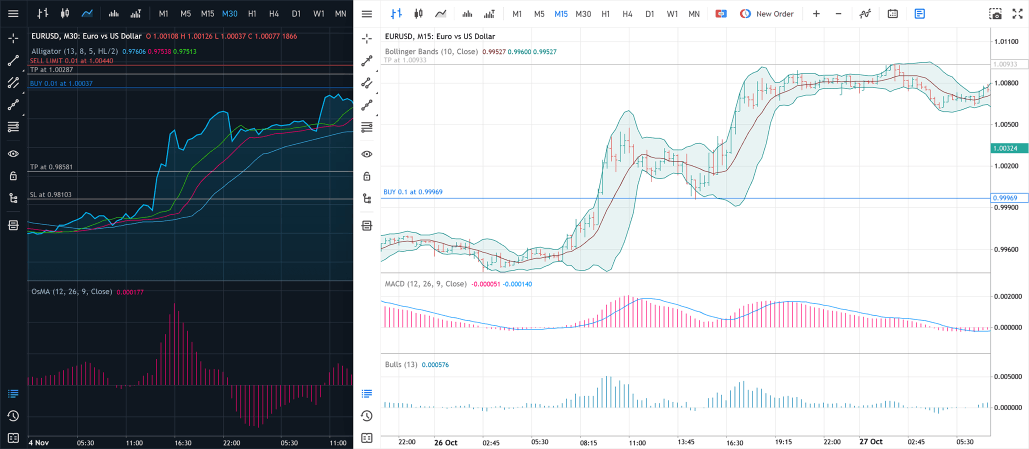

3 chart types and 9 timeframes

Multiple settings allow you to adapt the charts to your requirements

and create an efficient workspace. The platform supports three types of

charts: broken line, bars and Japanese Candlesticks. 9 timeframes are

available for each chart — from one minute to one month. Stock and

currency quotes can be presented on the timeframe which suits your

trading system best. In addition, the charts display additional

information that facilitates technical analysis: tick volumes, last

price lines, OHLC and more.

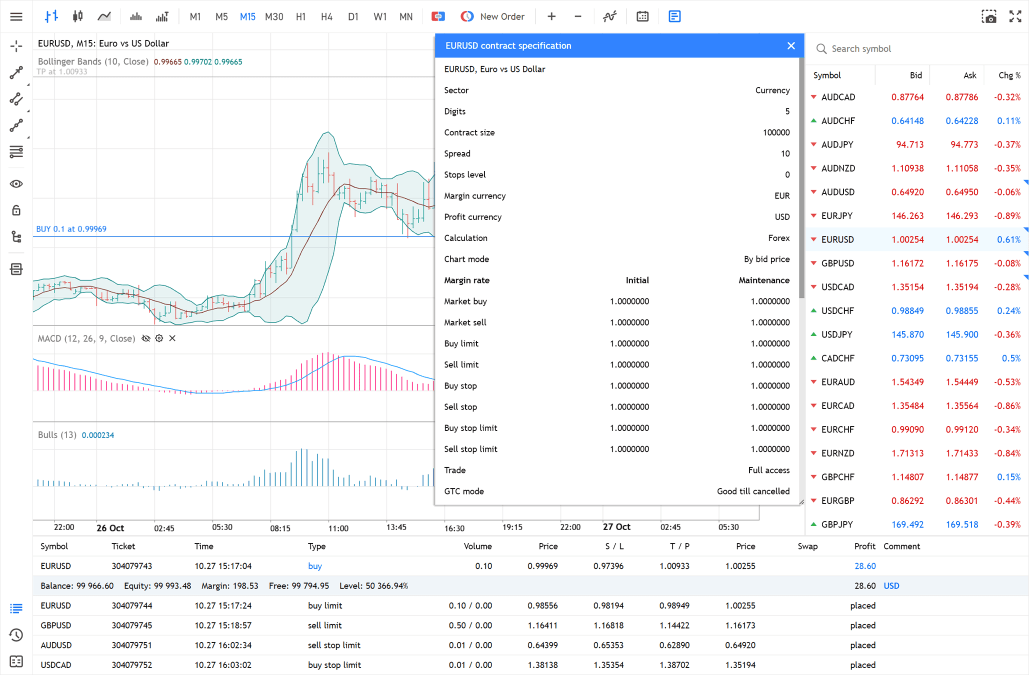

Real-time quotes in Market Watch

View price data of financial instruments: quotes, price statistics and tick chart. Analyze contract specifications and perform trades in one click.