News — MetaQuotes

News

MetaQuotes is excited to announce its participation in the highly anticipated iFX EXPO Asia 2023, scheduled for 20-22 June in Bangkok

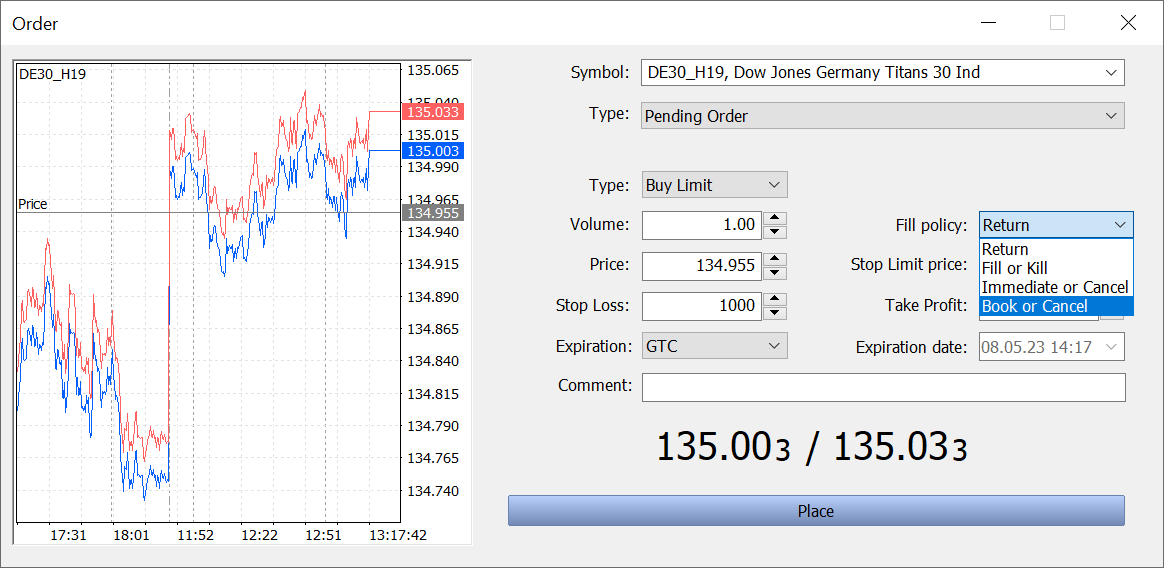

In the new version, we have added support for Book or Cancel orders. Such orders can only be placed in the Depth of Market, but they cannot be filled immediately. They are used to implement passive exchange trading.

On May 24 and 25, the MetaQuotes team will participate in Money Expo 2023 Mexico

The event, which will be held in Johannesburg, will be an excellent opportunity to expand partnerships with companies in the South African region.

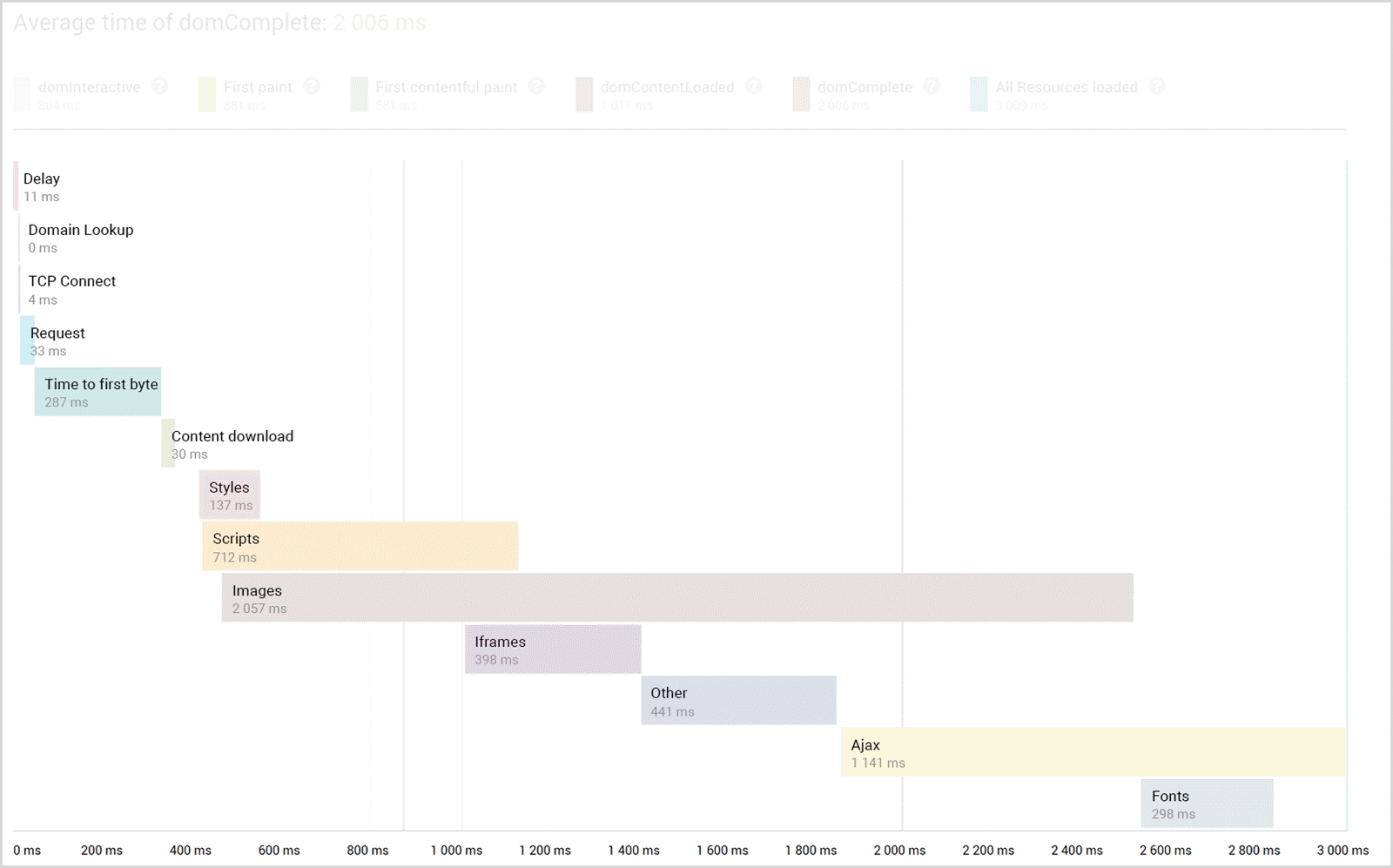

MetaTrader 5 Web is the perfect choice for those who need efficient and fully-fledged financial market trading from any device

The monthly audience of MetaTrader 5 for iOS set a record in the first month after returning to the Apple App Store

Fixed occasional incorrect platform log creation. Updated translations of the user interface.

All MetaTrader 5 users should have an equal trading experience and access to cutting edge technology, no matter which device they prefer

Added UI translations into 10 widely spoken languages: Simplified and Traditional Chinese, French, German, Italian, Japanese, Korean, Spanish, Turkish and Russian. This list will be further expanded in future versions.

We continue to develop the functionality of the web terminal, which allows you to work with MetaTrader 5 in any browser and from any device.

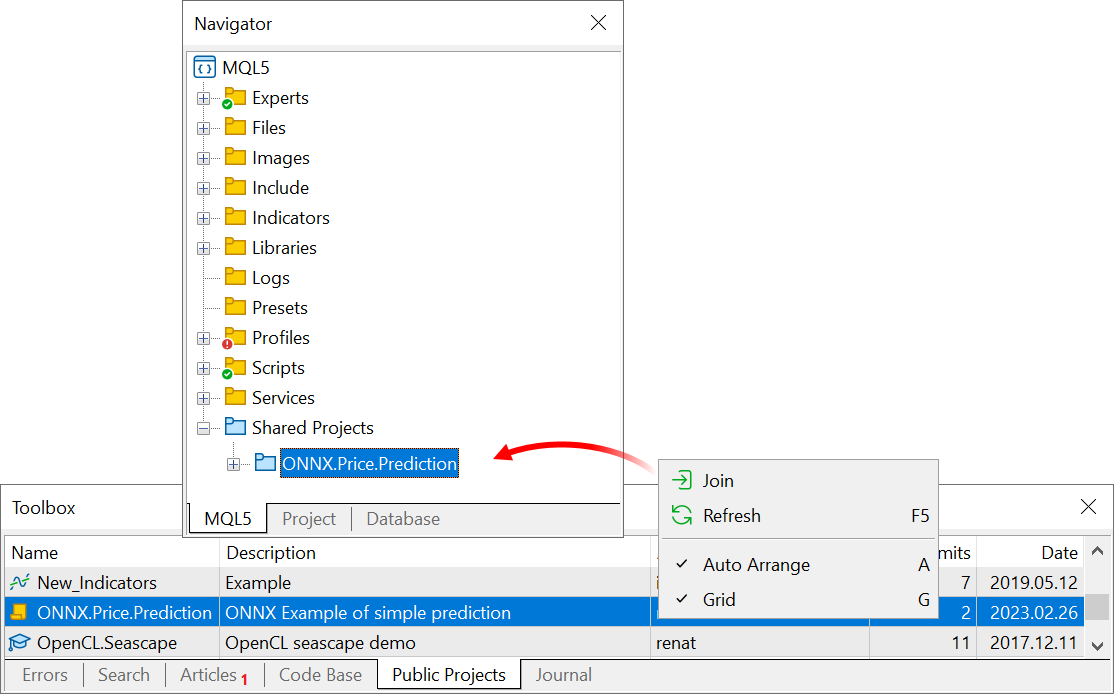

Added support for operations with ONNX models (Open Neural Network Exchange). ONNX is an open-source format for machine learning models.

MQL5.community turns 20 next year.

Added ability to place stop and stop-limit orders from the chart. Only limit orders were available in earlier versions. Select the required type by successively pressing the button in the bottom chart panel.

Building long-lasting relationships with customers is key to your business success. A long-term, repeat customer should be cherished as one of the best assets of your company. One of the essential business objectives is to build a loyal client base on which the company can rely even in difficult times.

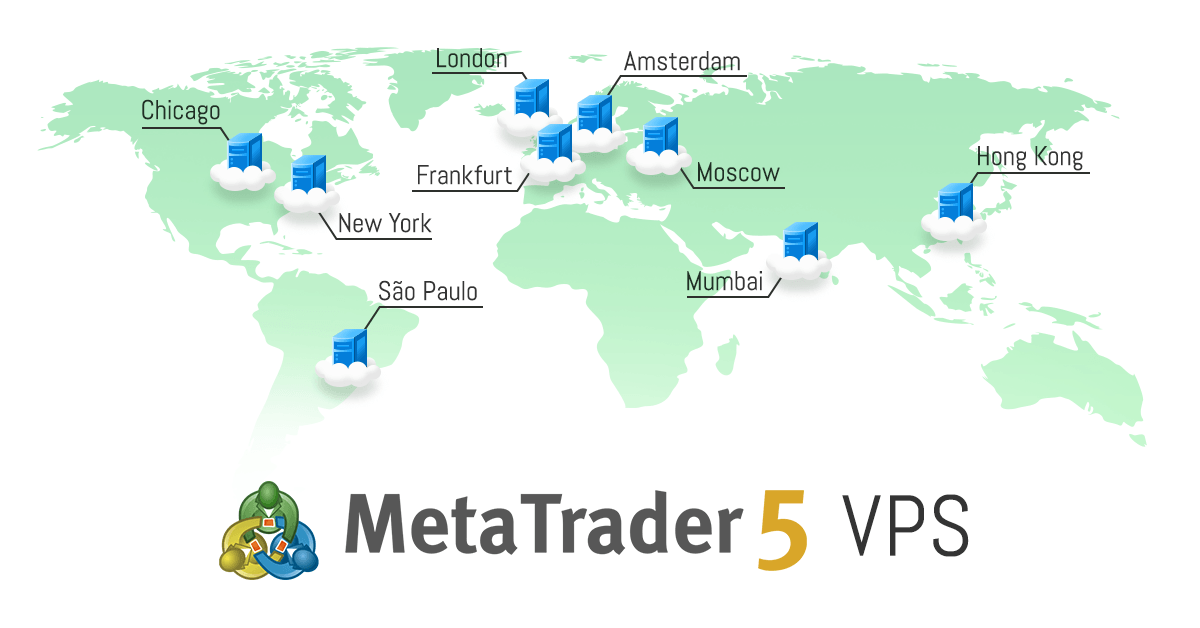

The VPS service is designed for round-the-clock operation of trading robots and signal subscriptions even when your computer is turned off. A Virtual Private Server (VPS) can be rented directly from the MetaTrader platform.

Meros Equity Global Management financial company has announced the launch of a new asset class and liquidity service for brokers - pre-IPO and IPO investments based on the MetaTrader 5 platform

Finteza provides much more tools which, in addition to providing unique information about the trading platform, can assist in making your site more attractive and popular among customers

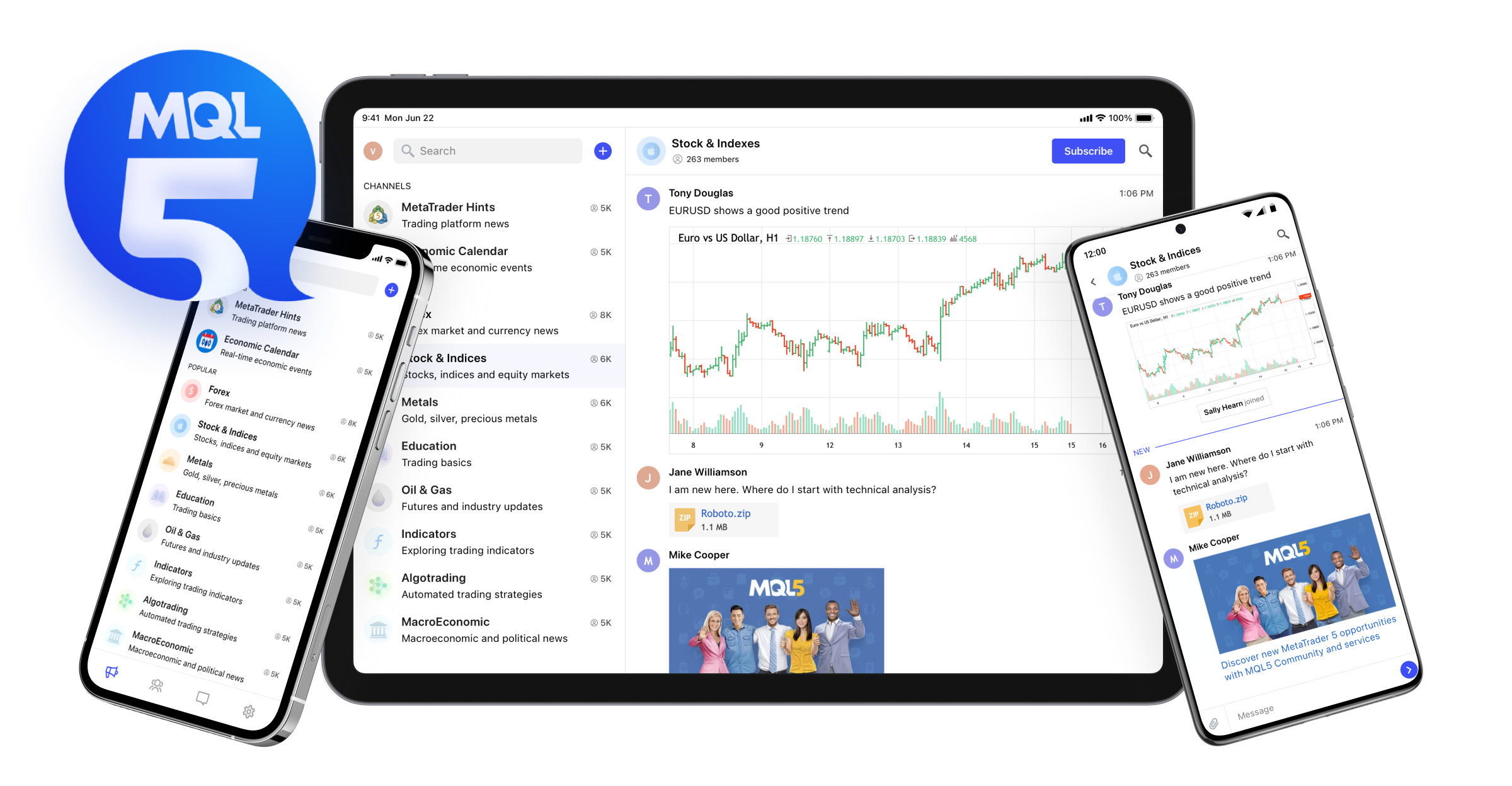

Follow financial news, chat with fellow traders from all over the world, and study technical and fundamental analysis using MQL5 Channels

MetaTrader 5 offers a much more efficient built-in solution which assists companies in avoiding manual work, in reducing error-related costs and in freeing up resources for exciting tasks