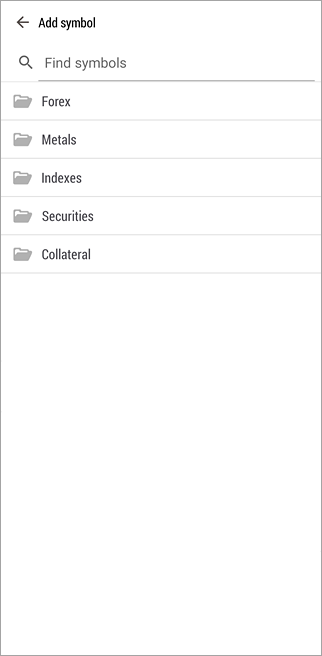

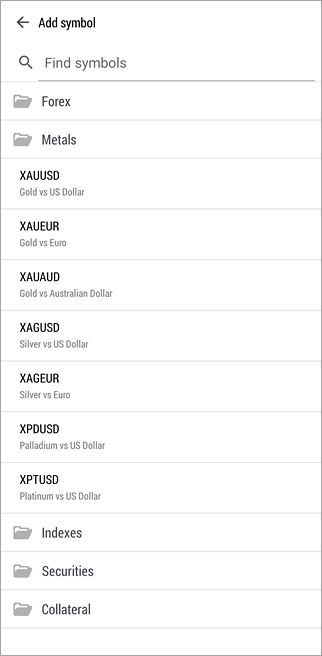

Adding Symbols #

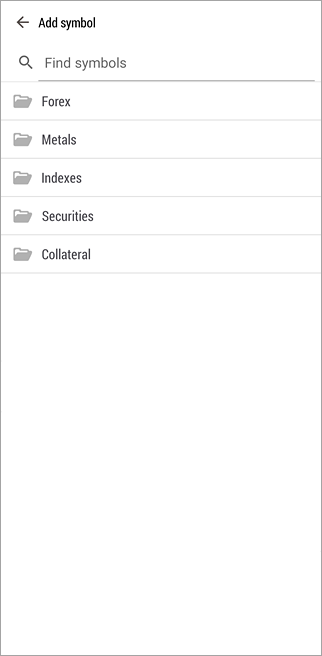

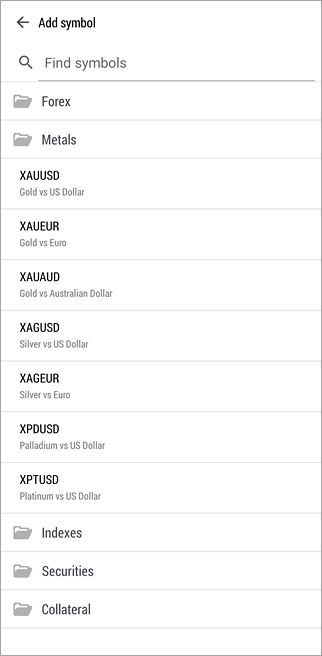

To add a new symbol, tap  at the top of the window. Select a group of symbols. To quickly find the desired symbol, use the search bar at the top of the page. Symbols are filtered as you type the symbol name. To add a symbol, tap on its line. at the top of the window. Select a group of symbols. To quickly find the desired symbol, use the search bar at the top of the page. Symbols are filtered as you type the symbol name. To add a symbol, tap on its line.

Hiding Symbols #

To hide a symbol, go to the edit mode by tapping  at the top of the "Quotes" tab. at the top of the "Quotes" tab.

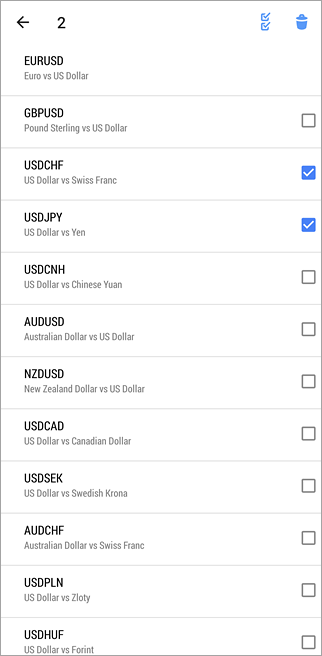

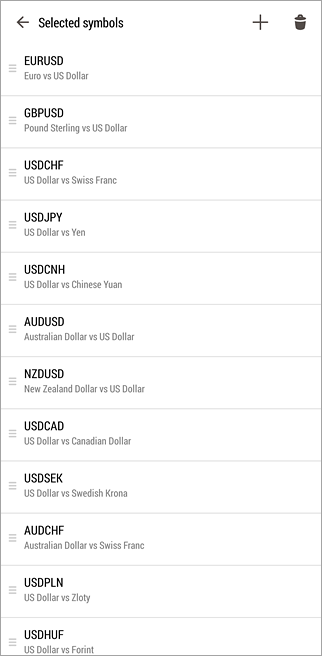

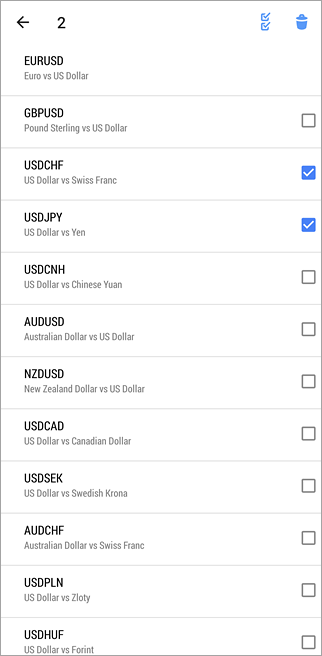

To hide symbols, tap  at the top of the window. Then check all the symbols that you want to delete, and once again tap at the top of the window. Then check all the symbols that you want to delete, and once again tap  . To select/deselect all symbols use button . To select/deselect all symbols use button  . .

Moving Symbols

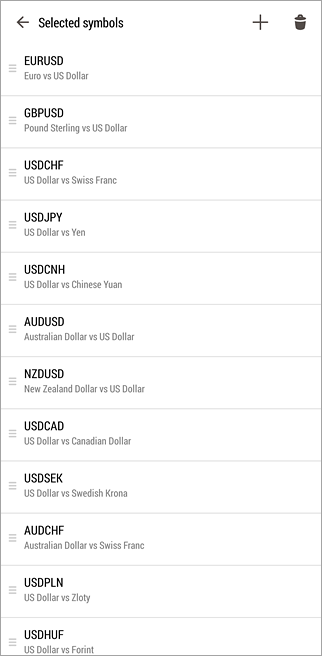

To change the order of symbols in the "Quotes" tab, use buttons  . Tap the button on the desired symbol, and holding it, drag the symbol to the desired position. . Tap the button on the desired symbol, and holding it, drag the symbol to the desired position.

|

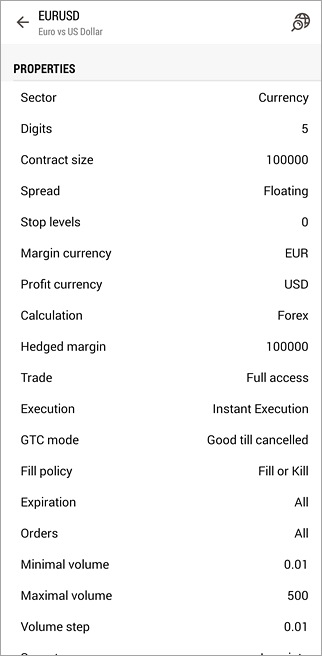

- Contract size – number of units of the commodity, currency or financial asset in one lot.

- Margin currency – currency, in which the margin requirements are calculated.

- Profit currency – currency, in which the profit of the symbol trading is calculated;

- Calculation – method of profit and margin calculation (Forex, Futures, Exchange Futures, Exchange Stocks, FORTS Futures);

- Tick size – the minimum price change step.

- Tick value – the cost of one price change point.

- Subscription – the broker may offer access to real-time quotes through a paid subscription. Without a subscription, data may be streamed with a delay. In this case, the value of this parameter will indicate the length of the delay.

- Chart mode – symbol chart (bar) construction mode: by last deal prices (Last) or by Bid prices. The first option is usually used for exchange instruments.

- Trade – symbol trading mode (full access, long only, short only, close only). Also, trading can be completely prohibited.

- Execution – execution mode: Instant, Request, Market, Exchange.

- Type of orders – types of orders placed:

- Good till today including SL/TP – orders that are valid only during one trading day. With the end of the day, all Stop Loss and Take Profit levels are deleted, as well as pending orders are removed;

- Good till canceled – pending orders are preserved for the next trading day.

- Good till today excluding SL/TP – when a trade day changes, only pending orders are deleted, Stop Loss and Take Profit levels are preserved.

- Fill policy– available order fill policy type: Fill or Kill, Immediate or Cancel, Book or Cancel, Return.

- Expiration – available types of expiration of pending orders:

- Good till Canceled – order lifetime is unlimited;

- Intraday – orders are canceled at the end of the current trading;

- Specified time – the order is canceled in a user-specified time;

- Date – the order is canceled at the end of the day specified by the user.

- Orders– allowed order types: market, limit, stop, stop-limit, Stop Loss and Take Profit.

- Minimal volume – minimal volume of a deal for the symbol.

- Maximal volume – maximal volume of a deal for the symbol;

- Volume step – step of volume changes;

- Volume limit – maximum allowed cumulative volume of an open position and pending orders by a symbol in one direction (buy or sell). For example, if the limit is set to 5 lots, a user can have an open buy position of 5 lots and place a Sell Limit order of 5 lots. But, the user cannot place a Buy Limit (because the cumulative volume in one direction will exceed the limit) or place a Sell Limit of more than 5 lots.

- Swap type – type of swap calculation:

- In points – the specified number of points of the security price.

- In the base currency – the specified amount in the symbol base currency;

- In the margin currency – the specified amount in the symbol margin currency;

- In the deposit currency – the specified amount in the deposit currency.

- As a percentage of current price – the specified percentage of the symbol price at the time of swap calculation;

- As a percentage of the open price – the specified percentage of the position open price;

- In points, re-open at Close price – at the end of the trading day the position is closed. The next day the position is re-opened at the close price +/- the specified number of points;

- In points, re-open at the Bid price – the position is closed at the end of the trading day. The next day the position is re-opened at the Bid price +/- the specified number of points.

- Swap long – swap for Buy positions.

- Swap short – swap for Sell positions.

- 3-days swap – day of the week when a triple swap is charged.

- First trade – the day when the financial instrument trading started;

- Last trade – the day when the financial instrument trading ended;

- Face value – nominal bond value set by the issuer;

- Accrued interest – part of the coupon interest of bonds, which is calculated in proportion to the number of days since the coupon bond issue date or since the previous coupon payment.

- Category – the property is used for additional marking of financial instruments. For example, this can be the market sector to which the symbol belongs: Agriculture, Oil & Gas and others.

- Exchange – the name of the exchange in which the security is traded.

- CFI – instrument classification in accordance with the ISO 10962 standard.

- Sector – economic sector the instrument belongs to, such as energy, finance, healthcare and others.

- Industry – industry branch the instrument belongs to, such as sportswear, accessories, car manufacturing, restaurant business and others.

- Country – country of the company whose shares are traded on the stock exchange.

- Option type – call or put.

- Underlying – the underlying symbol of the option.

- Strike price – option strike price.

Sessions

The lower part shows information about quoting and trading sessions of the symbol. Sessions are specified for every day of the week.

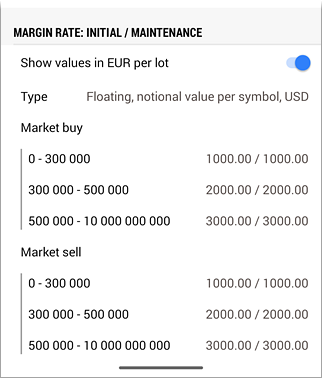

Margin #

The instrument specification may include the following values related to margin calculations:

- Initial margin – security deposit (margin) provided for a fixed-term contract to perform a one-lot deal. If the initial margin value is specified for the symbol, this is the value that is used. Margin calculation formulas are not applied to the appropriate calculation type.

- Maintenance margin – minimum security deposit (margin) a trader should have on his or her account to maintain a one-lot position.

- Hedged margin – the margin charged per one lot of hedged positions. You can also select here margin calculation mode for hedged positions – using the larger leg.

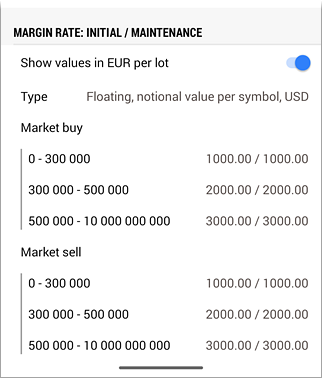

In addition, the specification contains a detailed table with margin rates and calculated values for each type of trading operation.

The type of margin calculation is displayed at the top:

- Notional value – common margin calculation based on the instrument type: Retail Forex, Futures or Exchange model.

- Floating: **** – additional rates can be applied to the common margin calculation depending on the volume or notional value of positions on the account. In this case, the table will indicate the corresponding ranges. This option is only used for the Retail Forex, Futures mode.

The "Initial" and "Maintenance" columns display margin rates. They are followed by the margin calculated based on the instrument type and rates.

In the above example, the margin depends on the volume of positions in the account. Three ranges are available:

Suppose there is already a position of 8 lots on the account, and you open a new position of 4 lots. In this case, the first two lots of the position will fall into the first range, and the applied margin will be 1,000 * 2 = 2,000. The other two lots will fall into the second range, and the margin will be 2,000 * 2 = 4,000. The total margin for the entire position will be equal to 2,000 + 4,000 = 6,000.

- The margin is calculated based on the instrument price at the time the specification window opens and is not updated in real-time. Therefore, the values should be considered indicative. To recalculate values based on current prices, reopen the instrument specification.

- The maintenance margin rate can be specified as zero, while the calculated value can be non-zero. This means that the maintenance margin rate is not explicitly specified, and the initial margin ratio is used instead.

|

Statistics #

To view additional price data, select the financial instrument in the Quotes section and tap Market Statistics. The following information is available:

- Bid – bid price;

- B. High – Bid High, the highest bid price for the current day;

- B. Low – Bid Low, the lowest bid price for the current day;

- Ask – ask price;

- A. High – Ask High, the highest ask price for the current day;

- A. Low – Ask Low, the lowest ask price for the current day;

- Last – the last price at which a deal was executed;

- L. High – Last High, the highest price at which a deal was executed for during the current day;

- L. Low – Last Low, the lowest price at which a deal was executed for during the current day;

- Volume – the volume of the last executed deal;

- V. High – Volume High, the highest deal volume for the current day;

- V. Low – Volume Low, the lowest deal volume for the current day;

- Deals – the total number of deals executed during the current session;

- Deals Volume – the total volume of deals executed during the current session;

- Turnover – money turnover for a symbol for the current session;

- Open Interest – the total volume of effective contracts (futures, options) which have been settled yet;

- Buy Orders – the total number of buy requests;

- Buy volume – the total volume of buy orders;

- Sell Orders – the total number of sell requests;

- Sell Volume – the total volume of sell orders;

- Open Price – the open price of the last (recent) session;

- Close Price – the close price of the last (recent) session;

- Average Weighted Price – the weighted average price for a session;

- Settlement Price – the settlement (clearing) price of the previous session;

- Price Change – indicates the difference between the last price of the instrument and the close price of the last session in percentage terms. The calculation formula depends on the symbol charting mode:

By Last prices: ((Last - Last price at session close)/Last price at session close)*100

By Bid prices: ((Bid - Bid price at session close)/Bid price at session close)*100.

For futures symbols, the clearing price is used instead of the the session close price, if the clearing price is provided by the broker (non-zero):

By Last prices: ((Last - Clearing price)/Clearing price)*100

By Bid prices: ((Bid - Clearing price)/Clearing price)*100.

- Delta – option delta. The Greeks, which include Delta, Theta, Gamma, Vega, Po and Omega, are quantities representing the sensitivity of the option price to changes in various parameters: strike prices, volatility, etc.

- Theta – option theta.

- Gamma – option gamma.

- Vega – option vega.

- Rho – option rho.

- Omega – option omega.

- Sensitivity – option sensitivity. It shows by how many points the price of the option's underlying asset should change so that the price of the option changes by one point.

The number of statistical values depends on the brokerage company.

|

Delayed Quotes #

Some brokers may provide access to certain market data only through a paid subscription, which can be purchased via the desktop version of the platform. Without a subscription, data may be delivered with a delay, offered as trial access so you can test your strategies in advance. In some cases, a delay in quotes may also be a requirement set by certain exchanges that provide the data.

If quotes for a symbol are being streamed with a delay, this will be indicated in the "Quotes" section and on the chart:

The delay value will be specified in the contract specification under the Subscription field.

Context menu #

To open the context menu, tap once on any of the symbols. The menu contains the following commands:

|