- Types of Orders

- Types of Execution

- State of Orders

- Fill Policy

Types of Orders

The MetaTrader 5 mobile platform allows users to prepare and issue requests for the broker to execute trading operations. In addition, the platform allows to control and manage open positions. For this purposes, several types of trade orders are used. An order is an instruction of a brokerage firm's client to conduct a trade operation. In the terminal, orders are divided into two main types: market and pending. Besides them there are "Stop Loss" and "Take Profit" orders.

Market Orders #

A market order is an instruction given to a brokerage company to buy or sell a financial instrument. Execution of this order results in committing a deal. The price at which the deal is conducted is determined by the type of execution that depends on the symbol type. Generally, a security is bought at the Ask price and sold at the Bid price.

Pending Orders #

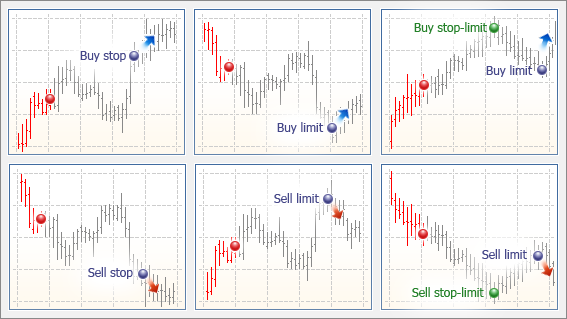

A pending order is the trader's instruction to a brokerage company to buy or sell a security in future under pre-defined conditions. Types of pending orders:

- Buy Limit – a trade request to buy at the Ask price that is equal to or less than that specified in the order. The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price, having fallen to a certain level, will increase.

- Buy Stop – a trade order to buy at the "Ask" price equal to or greater than the one specified in the order. The current price level is lower than the value in the order. Usually this order is placed in anticipation of that the security price, having reached a certain level, will keep on increasing.

- Sell Limit – a trade order to sell at the "Bid" price equal to or greater than the one specified in the order. The current price level is lower than the value in the order. Usually this order is placed in anticipation of that the security price, having increased to a certain level, will fall.

- Sell Stop – a trade order to sell at the "Bid" price equal to or less than the one specified in the order. The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price, having reached a certain level, will keep on falling.

- Buy Stop Limit – this type combines the two first types being a stop order for placing Buy Limit. As soon as the future Ask price reaches the stop-level indicated in the order (the Price field), a Buy Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set above the current Ask price, while Stop Limit price is set below the stop level.

- Sell Stop Limit – this type is a stop order for placing Sell Limit. As soon as the future Bid price reaches the stop-level indicated in the order (the Price field), a Sell Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set below the current Bid price, while Stop Limit price is set above the stop level.

|

|

– Current market state |

|

– Forecast |

|

– Current price |

|

– order price |

|

– the price, reaching which the pending order will be placed |

||

|

– Expected growth |

|

– expected fall |

Take Profit #

The Take Profit order is intended for gaining the profit when the security price has reached a certain level. Execution of this order leads to a complete closure of the position. It is always connected to an open position or a pending order. The order can be placed only together with a market or a pending order. This order condition for long positions is checked using the Bid price (the order is always set above the current Bid price), and the Ask price is used for short positions (the order is always set below the current Ask price).

Stop Loss #

This order is used for minimizing of losses if the security price has started to move in an unprofitable direction. If the price of the instrument reaches this level, the position is fully closed automatically. Such orders are always associated with an open position or a pending order. The order can be placed only together with a market or a pending order. This order condition for long positions is checked using the Bid price (the order is always set below the current Bid price), and the Ask price is used for short positions (the order is always set above the current Ask price).

|

Stop Loss and Take Profit inheritance rules (netting): #

- When increasing position volume or reverting the position, Take Profit and Stop Loss levels are placed according to its latest order (market or triggered pending order). In other words, in every new order of the same position stop levels replace previous ones. If zero values are specified in the order, Stop Loss and Take Profit of a position will be deleted.

- If a position is partially closed, Stop Loss and Take Profit are not changed by the new order.

- If a position is fully closed, the Stop Loss and Take Profit levels are deleted, because they are associated with an open position and cannot exist without it.

- If a trade operation is executed for a symbol, for which there is a position, the current Stop Loss and Take Profit of the open position are automatically inserted in the order placing window. This is aimed to prevent accidental deletion of current stop orders.

- During one click trading operation executed from the Market Depth for the symbol, for which there is a position, the current values of Stop Loss and Take Profit are not changed.

- On the OTC markets (Forex, Futures), when a position is moved to the next trading day (the swap), including through re-opening, the levels of Stop Loss and Take Profit are remain unchanged.

- On the exchange market, when a position is moved to the next trading day (the swap), as well as when moved to another account or during delivery, the levels of Stop Loss and Take Profit are reset.

Stop Loss and Take Profit inheritance rules (hedging):

- If a position is partially closed, Stop Loss and Take Profit are not changed by the new order.

- If a position is fully closed, the Stop Loss and Take Profit levels are deleted, because they are associated with an open position and cannot exist without it.

- During one click trading operation executed from the Depth of Market, the Stop Loss and Take Profit levels are not set.