- Adaptive Moving Average

- Average Directional Movement Index

- Average Directional Movement Index Wilder

- Bollinger Bands

- Double Exponential Moving Average

- Envelopes

- Fractal Adaptive Moving Average

- Ichimoku Kinko Hyo

- Moving Average

- Parabolic SAR

- Standard Deviation

- Triple Exponential Moving Average

- Variable Index Dynamic Average

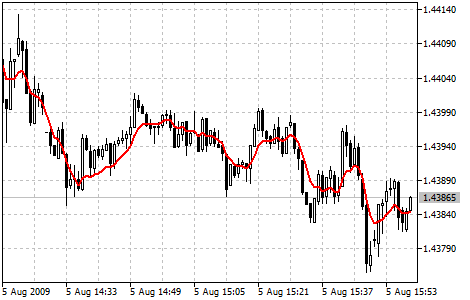

Double Exponential Moving Average

Double Exponential Moving Average Technical Indicator (DEMA) was developed by Patrick Mulloy and published in February 1994 in the "Technical Analysis of Stocks & Commodities" magazine. It is used for smoothing price series and is applied directly on a price chart of a financial security. Besides, it can be used for smoothing values of other indicators.

The advantage of this indicator is that it eliminates false signals at the saw-toothed price movement and allows saving a position at a strong trend.

You can test the trade signals of this indicator by creating an Expert Advisor in MQL5 Wizard. |

|---|

Calculation

This indicator is based on the Exponential Moving Average (EMA). Let's view the error of price deviation from EMA value:

err(i) = Price(i) - EMA(Price, N, i)

Where:

err(i) — current EMA error;

Price(i) — current price;

EMA(Price, N, i) — current EMA value of Price series with N period.

Let's add the value of the exponential average error to the value of the exponential moving average of a price and we will receive DEMA:

DEMA(i) = EMA(Price, N, i) + EMA(err, N, i) = EMA(Price, N, i) + EMA(Price - EMA(Price, N, i), N, i) =

= 2 * EMA(Price, N, i) - EMA(Price - EMA(Price, N, i), N, i) = 2 * EMA(Price, N, i) - EMA2(Price, N, i)

Where:

EMA(err, N, i) — current value of the exponential average of error err;

EMA2(Price, N, i) — current value of the double consequential smoothing of prices.